What Is Surplus Income?

If you are considering filing for bankruptcy, you may have many questions about the process, along with the costs of it.

Bankruptcy is a legal process that can help you get out of debt. When you file for bankruptcy, creditors stop calling and wage garnishments stop.

However, bankruptcy is a major decision that can affect finances for years to come.

If you have evaluated all your other debt-relief options and think bankruptcy is your best option, it is still essential to understand the full costs of bankruptcy.

During the bankruptcy process, you do have some legal obligations. One such commitment is paying any surplus income towards your debt.

Many of our clients ask us about surplus income and how it might impact them when they file for bankruptcy.

What is surplus income?

If your earnings are higher than what you need to maintain a reasonable standard of living, you may be required to make additional monthly payments towards the debt.

Surplus income is a cost of bankruptcy. When you are bankrupt, you can earn an income, but your salary or wage is subject to conditions. If you earn over the set guideline, you must pay a portion of the excess amounts towards the debt during bankruptcy.

Your surplus income payment amounts can change during bankruptcy if your earnings or household income changes.

How is surplus income calculated?

Surplus income is calculated using the standards set by the Office of the Superintendent of Bankruptcy Canada

To calculate surplus income, take your household’s net income, subtract any mandatory deductions, and then subtract the guideline amount for living expenses to get your total monthly surplus income.

If your surplus income is more than $200, you must pay half of this amount towards your debt while you are bankrupt.

If you want to estimate your potential surplus income payments, you’ll need to determine four inputs:

- Net Income for the Household

- Mandatory Deductions

- Living expenses guideline for your household

- Your share of the household income

Net Income for the Household

The net income used for surplus payment calculation is the entire household’s net income or take-home pay. That means that the calculation uses the combined take-home pay for both spouses for a married couple.

The net income used in the calculation is after mandatory deductions, such as provincial and federal income tax, pension deductions, and the deduction for employment insurance.

However, voluntary deductions cannot be deducted and are part of your income. For example, you might be making a regular contribution to your RRSP or towards your child’s RESP. You must add these to your income.

Any support payments you receive, such as social assistance, pension amounts, or Child Tax Benefit, are also included as a source of income.

Mandatory Deductions

The next step is to determine if you have any mandatory deductions that you pay that don’t come out of your paycheque.

Some examples of mandatory or non-discretionary deductions are:

- Child support payments;

- Spousal support payments;

- Child care expenses;

- Expenses for medical conditions;

- Unpaid court-imposed fines or penalties

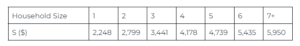

Living expenses guideline

The Office of the Superintendent sets a threshold based on what it thinks is a reasonable standard of living for your household’s size.

These amounts change annually and are used to calculate surplus income payments.

Here are the thresholds set living expenses for 2021:

Source: Office of the Superintendent of Bankruptcy Canada

Your share of the household income

The surplus income calculations consider what portion of the household income the bankrupt brings to the household. For example, if you are filing for bankruptcy and bringing in 40% of the income, that is the percentage subject to surplus income payments.

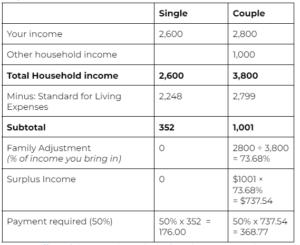

Sample Surplus Income Calculation

Here is an example of surplus income calculation for a single or a family of two to help understand the mechanics.

Source: Office of the Superintendent of Bankruptcy Canada

The calculation for surplus income payments can get quite complex depending on your financial situation. Calculating surplus income may become complicated if you have irregular income, are self-employed, or are a business owner.

If you are considering bankruptcy and need to understand your surplus income payments, it is vital to seek advice. Certified professionals, like our certified credit counsellors, take a look at your unique financial situation to help you make an informed financial decision.

How long will I have to make surplus payments?

If this is your first bankruptcy and you have surplus income, you will have to make payments for 21 months.

In the case of a second bankruptcy, you will make payments for 36 months

The surplus income amount may not stay the same during the bankruptcy.

If your household income changes during this time, it will impact your surplus income payments.

Evaluate your debt relief options.

Bankruptcy is a significant financial decision. You should consider all the facts you decide if you want to file for bankruptcy. While bankruptcy is one way to help you climb out of debt, it is not the only option.

It is essential to consider all the available options, such as a debt consolidation or a consumer proposal, before deciding what is best for you.

If you are struggling with the debt you owe and need help with a debt solution, or looking to pay down your debt, a certified credit counsellor at EmpireOne Credit is here to help.

We offer debt solutions to help you find the best way to get out of debt. Contact us for a Free Consultation.