How to Handle Your Finances Like a Pro

The reasons why most Canadians want to get better at their finances can differ. For some, they are tired of carrying credit card debts and taking out payday loans. For some, they got a better job and they don’t want to spend carelessly. For others, they just think the responsible thing to do is to be a good financial manager. One thing about personal finance is, there’s no one-size-fits-all, what works for Jonathan may not work for Janeth.

When it comes to handling your finances like a pro, you may have imagined so many things. For example, budgeting and sticking to it, having a robust emergency fund, having different investment portfolios that are yielding great returns, and being able to afford the life you desire. All of these are good and they are what makes you financially literate. In other words, to handle your finances like a pro all boils down to financial literacy.

Budgeting is the key

Budgeting might make some of us groan a little inside. But here’s a little secret: budgeting doesn’t have to be that bad. It’s actually more like that friend who’s always got your back, making sure you’re set for both the rainy days and the sunny ones.

Creating a budget is about knowing where every dollar is heading. Your budget is a personalised plan that fits your life, your goals, and yes, even your splurges.

Now, if the thought of setting up a budget has you breaking out in a cold sweat, relax. There are tons of tools and apps out there designed for the rest of us. Imagine having a clear picture of your finances right at your fingertips, it will help you know where to adjust.

Whether you’re managing debt, saving for something big, or just trying to get a better handle on your spending, a good budget is your first step towards financial freedom.

You can’t do without savings

Saving money doesn’t have to feel like a sacrifice. It’s about setting yourself up for success and preparing for the future.

But where do you start? How do you save without feeling like you’re just scrimping and scraping by?

First off, let’s talk about setting goals, the kind that makes you feel fulfilled. Whatever the goal is, having a clear one makes saving feel less stressful.

There are also TFSAs and RRSPs, they are high-interest savings accounts you can use to save. Imagine putting your money in a place where it not only sits safely but also gets a chance to grow, tax-free or with tax advantages.

Also, having an emergency savings account is an important necessity. The same way you can’t do without food, you can’t do without having an emergency fund. There are times when some emergencies would show up and you need to fix them immediately. Reaching out to your credit card every time you have an emergency can get you deep in debt. Handling your finances like a pro is incomplete without a good understanding of savings.

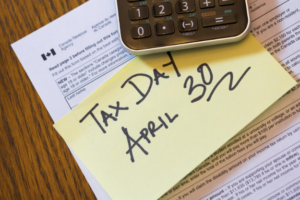

File your taxes

Filing taxes in Canada doesn’t have to be something that makes you confused and tremble. In fact, with a bit of know-how, you can handle tax season like a pro, and maybe even find a few opportunities to save some money along the way.

The Canadian tax system is progressive, which means the more you earn, the higher the percentage you pay. But it’s not just about paying up; it’s also about knowing what deductions and credits you’re eligible for, which can also lower your tax bill.

One of the first things to get a handle on is the difference between tax deductions and tax credits. Deductions lower your taxable income, which, in turn, can reduce the amount of tax you owe. Like RRSP contributions, which can be a big win when tax season comes. Tax credits on the other hand directly reduce the amount of tax you owe, dollar for dollar. Credits cover a wide range of things, from tuition fees to charitable donations, and even public transit passes.

One important tip is, don’t wait until the last minute before you file. The deadline for most Canadians is April 30, but filing early means you avoid the rush, and reduce stress, and if you’re owed a refund, you get that money fast.

With a little preparation and knowledge, you can handle tax season with confidence.

Debt management

Managing and getting rid of debt is entirely possible. In Canada, we’re dealing with various kinds of debt, from credit cards to student loans to mortgages, and so on.

First off, understanding the types of debt you’re dealing with is crucial. Not all debt is created equal. Credit card debt, for instance, is notorious for its high-interest rates, so it should be a top priority. On the other hand, student loans and mortgages often come with lower interest rates but they also need to be prioritised.

But what if you find yourself in a situation where the debt feels overwhelming, where it’s not just about strategy but about finding a solution? That’s when seeking professional help can make all the difference. You can speak with debt experts at EmpireOne Credit and get an understanding of debt consolidation, consumer proposal, or bankruptcy.

Conclusion

Other important aspects of your finances include investment and insurance. Investment helps you build wealth and insurance protects what you have built.

Handling your finances like a pro is possible, but when big debts stand in the way, you may feel incapable. Do you know your debt can be reduced by up to 80%, and interest will stop immediately? You can speak with one of our debt experts at EmpireOne Credit to get assistance. Call us at (416) 900-2324 to schedule a free consultation with us. Being debt-free feels good!